Blogs

Setting Algorithmic Risk Parameters Effectively

Dec 8, 2025

Setting Algorithmic Risk Parameters Effectively

In algorithmic trading, strategy design often receives the most attention, while risk management tends to be an afterthought. Yet in practice, algorithmic risk parameters are what determine whether a trading system survives long term. Even an effective strategy can fail when risk controls are weak or inconsistent.

This guide outlines the core principles, practical methods, and data-driven techniques used to create reliable risk assessment, risk mitigation, and risk management frameworks for algorithmic systems operating in modern financial markets.

Why Algorithmic Risk Management Matters

Most trading algorithms do not fail because they cannot detect valid buy or sell signals. Traders fail when they allow risk exposure to remain unregulated. Without proper parameters, an algorithm can accumulate losses rapidly, amplify volatility, or behave unpredictably under stress.

Strong risk controls:

protect capital during losing streaks

prevent emotional decision-making

enforce consistent behavior across market conditions

allow an algorithmic edge to play out over the long term

reduce vulnerability to high-risk and systemic risks

Effective risk management is the foundation that keeps both short term and long term strategies stable.

Core Principles for Setting Risk Parameters

Before deploying any strategy, traders and quants must determine the acceptable level of risk at both the trade and portfolio level. These parameters drive all downstream components, including position sizing, stop-loss placement, and execution logic.

1. Risk Per Trade: Percentage vs. Fixed Dollar

Two common approaches define the maximum loss for any single trade:

Percentage-Based Risk

A fixed percentage of account equity is risked on each trade.

Example: 1% risk on a $10,000 account = $100 per trade.

As the account changes, the dollar value adjusts automatically. Traders prefer this approach because it controls exposure as volatility shifts.

Fixed Dollar Risk

A constant dollar amount is risked per trade, regardless of account size.

This method is simpler but does not adapt to growth or drawdowns.

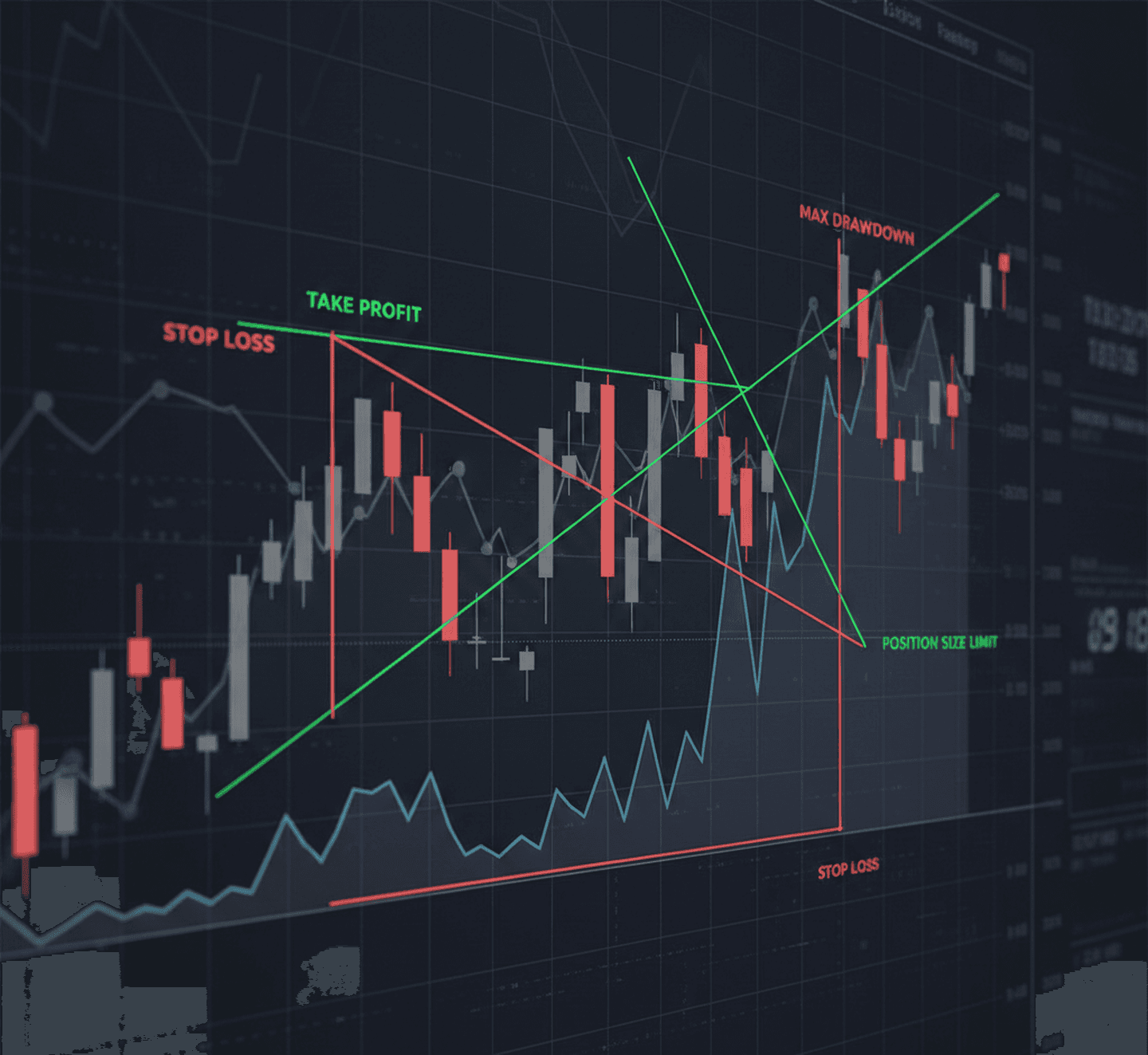

2. Position Sizing Based on Stop-Loss Distance

Professional risk frameworks link trade size to stop-loss distance.

The wider the stop, the smaller the position; the tighter the stop, the larger the position.

Formula:

Position Size = Risk Amount ÷ Stop-Loss Distance

This ensures that each position matches the planned risk, regardless of market conditions.

Tight stops, while appealing, often lead to premature exits caused by normal price noise. For this reason, many systems also use a minimum stop-loss distance, calculated using volatility indicators or ATR values.

Implementing Risk Parameters in an Algorithmic System

Risk rules should not remain conceptual—they must be coded directly into the algorithm.

A typical sequence includes:

Signal detection using technical analysis or model logic

Stop-loss placement at a volatility-adjusted level

Risk amount calculation based on account parameters

Position-size calculation using the risk formula

Validation checks, such as minimum stop-loss distance

Risk-reward ratio assignment (e.g., 2:1 target)

These steps ensure every order follows the same disciplined risk structure, independent of human emotions or discretion.

Platforms such as Nvestiq now allow traders to create these logical structures using natural language, eliminating the need for manual coding while still enabling precise control over risk parameters.

Backtesting With Risk in Mind

Effective backtesting is not limited to profit evaluation. A reliable risk assessment includes:

maximum drawdown

average loss per trade

frequency of risk-limit breaches

distribution of winning vs. losing trades

short term and long term volatility behavior

impact assessments under different market conditions

Algorithms must be tested on years of historical data to reveal weaknesses, confirm resilience, and validate whether the risk parameters produce stable performance.

Selecting an Appropriate Risk-Reward Ratio

The risk-reward ratio determines how much profit a system aims to capture relative to the loss it is willing to take.

Common ratios:

1:1 (balanced)

2:1 (target is twice the risk)

Strategies with a higher average win than average loss tend to perform better over time, even with modest win rates.

Simulation studies show that increasing the ratio from 1:1 to 1.5:1 or 2:1 significantly improves long-term survival and profitability.

Managing Portfolio-Level and Daily Risk

When running multiple strategies or trading several assets, the risk of compounding losses increases.

To mitigate this, many traders set:

daily loss limits

max number of trades per day

portfolio-wide exposure limits

Example:

A $50,000 account may halt trading for the day if losses reach $1,000.

Brokerage platforms often provide tools such as:

auto-liquidation thresholds

trading-hour restrictions

asset-blocking settings

maximum drawdown rules

These safeguards prevent catastrophic losses during extreme market events.

Data-Driven Optimization of Risk Parameters

Modern risk management relies on statistical analysis rather than intuition.

Data sources such as historical volatility, return distributions, and asset-specific behaviors inform more accurate parameter selection.

Useful analyses include:

historical drawdown studies

volatility clustering patterns

ATR-based stop-loss modeling

return distribution curves

sensitivity testing (changing one parameter at a time)

Different assets behave differently—high-volatility stocks, currency pairs, and crypto instruments require unique risk settings.

Traders must tune risk parameters for each instrument instead of copying them across markets

Common Risk Management Errors

Frequent mistakes include:

risking too much per trade

ignoring volatility when placing stops

overtrading during high-risk sessions

assuming one set of parameters fits all markets

ignoring commissions, spread, or slippage

relying on high-risk strategies without mitigation

Even strong strategies can fail when paired with improper risk parameters.

Final Thoughts

In algorithmic trading, a strong strategy relies not only on its signals but also on the quality of its risk management

Accurate and consistent risk parameters based on data improve stability. They reduce emotional interference and help algorithms perform well in both short-term and long-term markets.

Mastering risk is not optional. The foundation allows any trading strategy to survive, adapt, and thrive within complex financial markets.

If used carefully, the ideas in this guide can improve decision-making for any algorithmic system. They can also boost performance and safety in many trading situations.