Futures Demo Account: How to Transition to Live Trading

Jan 23, 2026

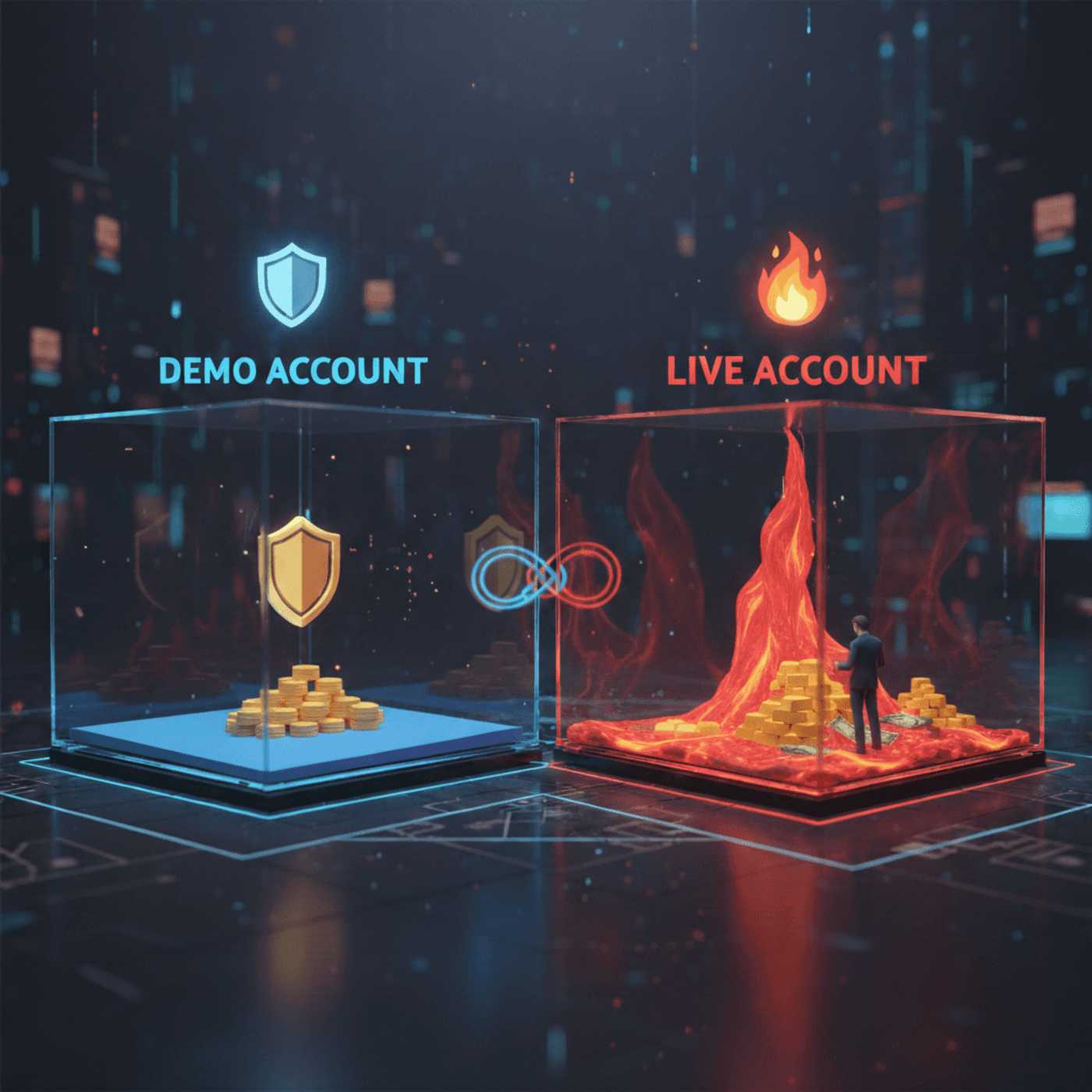

Transitioning from a Futures Demo Account to Live Trading

Transitioning from a futures demo account to live trading is a significant step for any trader. It requires careful planning and a solid understanding of trading principles. A futures demo account offers a risk-free environment to practice futures trading and refine strategies through sim trading and trade simulation. This guide will help you navigate the transition smoothly. Learn how to leverage demo trading to build confidence and prepare for the live market.

Understanding Futures Demo Accounts

A futures demo account (often called a futures trading demo account or simply a futures demo) offers a virtual platform to practice trading without financial risk. This tool is essential for new traders. It mimics real market conditions, allowing individuals to explore trading strategies. Experiencing market fluctuations in a simulated environment helps users understand market dynamics. Demo accounts are invaluable for building trading confidence.

Traders can simulate the trading of various futures contracts using these accounts. This includes commodities, currencies, and indexes. Exploring different markets helps traders diversify their knowledge. Moreover, practicing with a demo account is a stepping stone to grasp complex trading concepts. Engaging in this practice develops necessary skills, including futures paper trading and the ability to paper trade futures before risking capital.

Many brokers also provide a free futures demo account or a free paper trading account, giving you a dedicated futures paper trading account to experiment safely.

In a demo trading environment, you can test new strategies and refine existing ones. It's the perfect setting to understand the impact of leverage and margin and to run a realistic trading test. The following points summarize the reasons to use demo accounts:

Test trading strategies without risk

Understand market behavior

Explore different asset classes

Develop risk management techniques

Gain familiarity with trading platforms

Conduct a realistic trading test in a simulated market

What is a Futures Demo Account?

A futures demo account is a simulated trading environment. It allows traders to practice without using real money. This tool mimics actual market conditions, providing valuable experience. Using it helps traders learn trading mechanics and develop strategies.

Aspiring traders benefit immensely from demo accounts. They offer a safe arena to practice and improve before going live. By using this tool—sometimes referred to as a futures trading demo account—traders can prepare thoroughly for real-world trading challenges.

Benefits of Using a Futures Demo Account

Using a futures demo account comes with numerous benefits. Traders can test strategies and learn market behavior in a risk-free environment. It helps in developing crucial trading skills.

Notable benefits include:

Zero financial risk while practicing

Ability to test various strategies

Understanding market behavior and trends

Evaluating trading platforms and tools

Additionally, it helps traders learn about market timing and execution without pressure, especially when they paper trade futures before going live.

Features of a Quality Futures Demo Account

A quality futures demo account offers key features to enhance learning. Look for these features to maximize the benefit:

Realistic trading environment

Access to various futures markets

Comprehensive trading tools

User-friendly interface

These attributes ensure a productive and educational trading experience.

The Role of a Free Paper Trading Simulator

A free paper trading simulator is an essential tool for aspiring traders. It provides a platform to learn market dynamics without financial risk. Simulators replicate real-time trading scenarios. Users can test strategies and adapt to market conditions. Many platforms also include a market replay simulator to practice after hours with historical data.

These tools allow traders to experiment with various strategies. By replaying past data, traders can practice under different market conditions. This helps refine trading techniques without the fear of loss.

Moreover, paper trading simulators offer insights into market behavior. They help traders develop a systematic approach to trading. Here's why you should use a free paper trading simulator:

Practice without risk

Test various strategies

Experience real market conditions

Learn market timing

Improve decision-making skills

A paper trading simulator fosters a strong understanding of trading principles. It's an essential step before transitioning to live trading. Many brokers provide a day trading simulator free or a day trade simulator free (sometimes labeled a daytrade simulator) alongside a general trading simulator free for futures-focused practice.

Advantages of Free Paper Trading Simulator

A free paper trading simulator offers multiple benefits. It's an invaluable tool for learning and practicing trading skills. Here are some advantages:

Real-time market simulation

Risk-free learning environment

Testing strategies in various scenarios

By utilizing these simulators, traders can build confidence and refine their trading approach. It's a cost-effective way to get started in trading. Look for a free futures trading simulator that supports free futures paper trading so you can progress at your own pace.

How to Effectively Use the Simulator Trading

To maximize the benefits of simulator trading, follow these guidelines. Start by setting clear objectives. Define what you want to achieve.

Practice consistently to gain experience. Use the simulator regularly to familiarize yourself with market movements. Keep track of your progress by maintaining a trading journal. Record strategies and results for analysis.

If you’re exploring how to practice day trading for free—or more broadly how to practice trading for free—apply these steps within your preferred day trade simulator.

Here's a checklist to make the most out of simulator trading:

Set specific trading goals

Monitor progress through a journal

Consistently engage in practice

Review and analyze past trades

Experiment with different markets

By adhering to these practices, traders can build a strong foundation. This prepares them for the challenges of live trading.

Transition Strategies: From Demo to Live Trading

Transitioning from a futures demo account to live trading is a significant step. This progression requires careful planning and strategy. Understanding this transition can help mitigate risk and enhance confidence.

Traders need to prepare mentally and strategically for live markets. The shift involves real money, which brings emotional challenges. Having a structured transition plan is crucial.

Start by reviewing your demo trading performance. Identify what worked and areas needing improvement in your demo futures trading. This helps develop realistic expectations and goals.

Develop discipline by setting clear rules for live trading. Stick to these rules to avoid impulsive decisions. A gradual approach helps ease the transition.

Consider starting with a small account. This limits potential losses while gaining live experience. You can gradually increase position sizes as confidence grows. After you paper trade futures successfully, scale up thoughtfully.

Here's a checklist for a smooth transition:

Analyze demo trading results

Set specific trading goals

Develop a robust trading plan

Start small; scale gradually

Maintain emotional control

With these strategies, traders can manage risks and enhance their chances of success.

Developing a Trading Plan

A trading plan is a roadmap for successful trading. It provides structure and clarity during the transition. Establishing a well-thought-out plan is essential for consistency.

Include clear entry and exit criteria in the plan. Define risk management rules like stop-loss levels and position sizing.

Essential components of a trading plan include:

Entry and exit strategies

Risk management rules

Trading goals and objectives

Having a solid plan reduces emotional decision-making. It provides a foundation for disciplined trading.

Managing Risk Before Going Live

Managing risk is a vital aspect of trading. It protects your capital and maintains trading sustainability. It's crucial to establish a risk management strategy before transitioning.

Set a maximum loss limit per trade. This determines the amount you can lose without affecting your capital. Use stop-loss orders to enforce this limit.

Consider these elements for risk management:

Determine acceptable loss levels

Use stop-loss orders

Limit position sizes

By managing risk, traders can avoid catastrophic losses. It ensures they can recover and continue trading after setbacks.

Key Differences Between Demo and Live Trading

Understanding the differences between demo and live trading is crucial. It's not just about money. The emotional aspect is a significant factor.

In live trading, real money is at stake, which can trigger emotions like fear and greed. This may affect decision-making. Therefore, emotional control becomes paramount.

Key differences include:

Emotional impact of real money

Market slippage and execution issues

Psychological pressure of losing capital

Awareness of these differences helps traders prepare for live markets. It aids in formulating strategies to manage these challenges effectively.

Tools and Platforms for Paper Trade Futures

Selecting the right tools and platforms is key to effective practice. A quality paper trading platform simulates market conditions accurately. It provides a realistic trading experience, whether you prefer a futures trading simulator or a more general future simulator for concept testing.

Look for platforms that offer extensive features. Real-time data, charting tools, and market analysis features are beneficial. These tools enhance your learning and trading skills and support robust trade simulation.

Here's a checklist for evaluating paper trading platforms:

Access to real-time market data

Comprehensive charting and technical analysis tools

User-friendly interface with educational resources

Engaging with a versatile platform supports strategy testing. It helps traders gain confidence before transitioning to live trading. Opening a free paper trading account can accelerate learning and make practice day trading more accessible.

Best Paper Trading Platform for Futures

Choosing the best platform involves assessing features and reliability. Different traders have different needs. A good platform should align with your trading objectives.

Key features to look for include:

High-quality market data

Advanced charting capabilities

Intuitive user interface

Explore various platforms to find one that fits your style. Ensuring they have comprehensive support and resources is also beneficial for learning.

Free Options Trading Simulator vs. Futures Trading Simulator

Options and futures trading simulators serve distinct purposes. Understanding their differences helps in deciding which to use. Each type benefits specific trading strategies.

Consider these factors when choosing:

Trading objectives and strategy alignment

Complexity and learning curve of the market

Features specific to options or futures trading

Choose a simulator that suits your targeted asset class. Both options and futures simulators offer valuable practice but cater to different trading dynamics. Many platforms also integrate a market replay simulator for both asset classes to deepen learning.

Conclusion: Embrace the Journey

Transitioning from a futures demo account to live trading is a significant step. It's a journey filled with learning and growth. Trust the process and embrace each moment.

Remember, patience and practice are essential. As you move to live trading, maintain the habits developed during practice. The skills gained from a demo account are invaluable.

Building a successful trading career involves continuous learning. Adapt to market changes and refine strategies. Make informed decisions and stay focused on your trading goals.

Next Steps After Practicing Futures Trading

After mastering a futures demo account, start small in live trading. Test your skills gradually to build confidence. Monitor your trades closely and analyze results.

Review performance regularly to identify areas for improvement. Continue refining your trading plan. Successful trading relies on constant growth and adaptation. Keep your free paper trading account active to pilot new ideas while you trade live.

Maintaining Discipline in Live Trading

Maintaining discipline is crucial when live trading. Emotions can be challenging. Stick to your trading plan and manage risks effectively.

Avoid impulsive decisions driven by market swings. Keeping a clear mindset helps. Remain focused on long-term objectives.

Practice emotional control and consistency. These attributes are fundamental for achieving trading success.