Blogs

Strategies for Optimized Trading

Dec 15, 2025

Strategies for Optimized Trading Success

Optimized trading is a game-changer in the financial world. It combines strategy, technology, and analysis to maximize returns.

Traders are constantly seeking ways to improve their performance. Optimized trading offers a structured approach to achieve this goal.

By leveraging advanced trading strategies, traders can navigate the complexities of the market. This includes both manual and automated methods.

Algorithmic trading, or algo trading, plays a significant role. It uses computer programs to execute trades based on set criteria.

Understanding these strategies is crucial for success. This guide will explore effective methods for achieving optimized trading success.

Understanding Optimized Trading

So what is optimized trading? Optimized trading focuses on maximizing profit while minimizing risks. It requires a keen understanding of market mechanics. Traders use various strategies to achieve balance and sustain profitability.

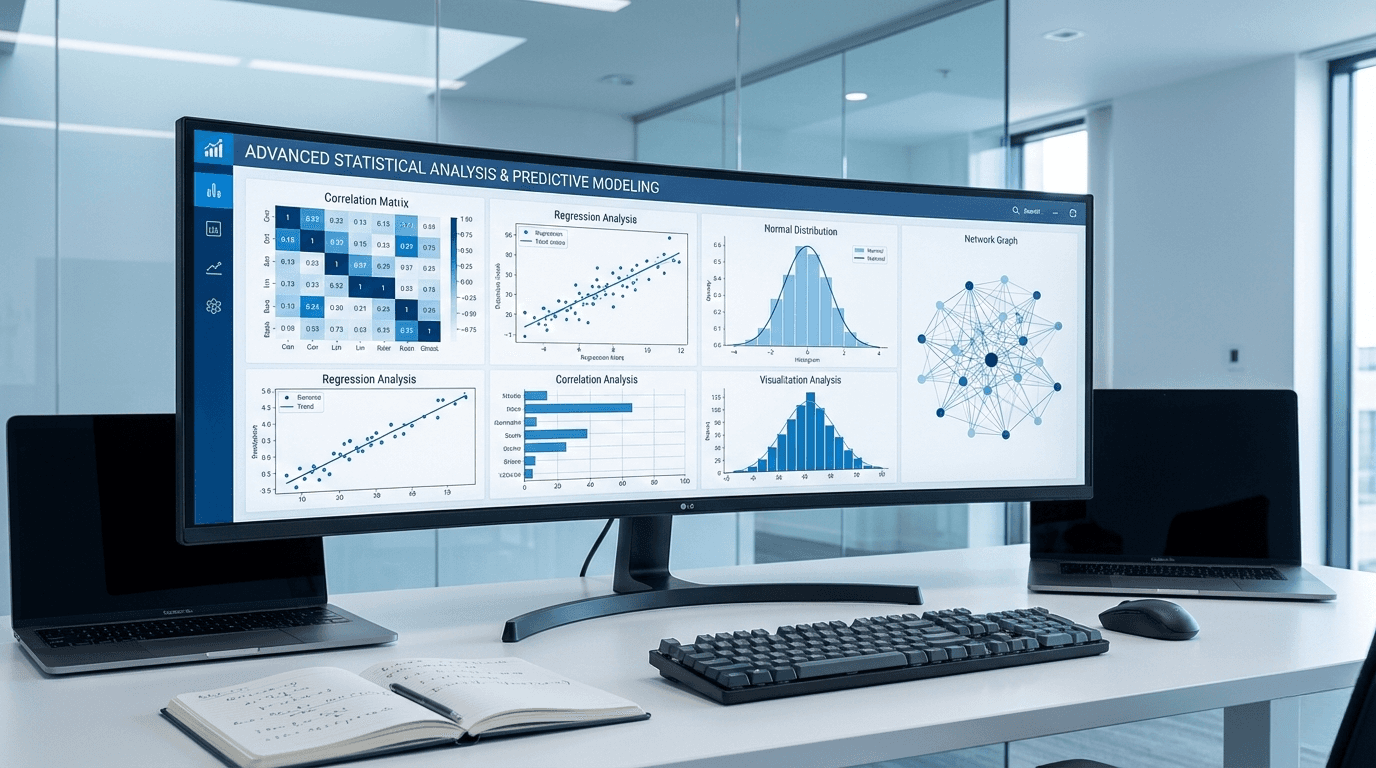

The key to optimized trading is comprehensive market analysis. This involves understanding trends and patterns. Traders must interpret data effectively for informed decision-making.

There are two main types of trading strategies: manual and automated. Manual trading relies on human intuition and analysis. Automated trading, particularly algorithmic trading, uses computer algorithms to facilitate decision-making.

Key aspects of optimized trading include:

Utilizing data-driven insights for strategy development

Employing algorithms to automate trade execution

Implementing risk management techniques to prevent losses

By combining these elements, traders can refine their approach and achieve better results. The integration of technology and traditional methods allows for more precise and responsive trading decisions. In the competitive landscape of financial markets, mastering these concepts is essential for optimized trading success.

Core Trading Strategies for Success

Successful trading hinges on using well-crafted strategies. These strategies guide decision-making and help traders navigate market complexities effectively.

A robust trading strategy combines technical and fundamental analysis. Technical analysis focuses on historical price patterns. Fundamental analysis evaluates financial health and market conditions. Both provide crucial insights for making informed trades.

Traders often employ a diverse range of strategies. Some focus on rapid trades, while others take a long-term approach. Each strategy requires a tailored plan based on specific goals and risk tolerance.

Popular trading strategies include:

Scalping: Making numerous small trades to capitalize on minor price changes.

Swing Trading: Capturing gains over several days or weeks.

Position Trading: Holding trades for an extended period to exploit long-term trends.

Mean Reversion: Assuming that prices will return to their historical averages.

Trend Following: Riding the momentum of current market trends.

To select the best strategy, traders need to consider market conditions, personal preferences, and risk capacity. Regularly updating and fine-tuning these strategies is critical for staying relevant. By adopting a flexible mindset and continuously learning, traders can enhance their chance of success in optimized trading.

The Role of Algorithmic and Algo Trading

Algorithmic trading, often termed algo trading, plays a vital role in today's trading landscape. It uses computer programs to execute trades based on predetermined criteria. These algorithms analyze vast amounts of data swiftly, providing traders an edge in fast-paced markets.

Algo trading offers several advantages over manual trading. It minimizes human error, increases execution speed, and removes emotional bias. By relying on precise calculations, it enhances efficiency and reliability in trade execution.

Many traders turn to algorithmic trading to capitalize on price discrepancies in various markets. High-frequency trading, a subset of algo trading, executes thousands of trades in milliseconds. This method seeks profit opportunities from small price movements, requiring powerful technology.

Common features of algo trading include:

Automated Decision-Making: Set rules trigger trade actions without manual input.

High-Speed Execution: Lightning-fast processing allows seizing split-second market openings.

Data-Driven Analysis: Algorithms analyze complex data sets to identify optimal trade opportunities.

While algorithmic trading holds promise, it requires a deep understanding of both technology and market dynamics to succeed. Traders must ensure their algorithms align with market conditions for effective results. Implementing robust risk management strategies is also essential in minimizing potential losses.

Essential Elements of an Optimized Trading Plan

Creating an optimized trading plan is critical to achieving consistent trading success. A well-defined plan provides clarity and direction in the ever-changing financial markets. It aligns trading activities with personal financial goals and risk tolerance.

An effective trading plan includes several key components. Setting clear objectives is essential; it keeps traders focused and motivated. Identifying preferred asset classes and market conditions aids in selecting suitable trading strategies.

Risk management plays a crucial role in any trading plan. By specifying risk limits for each trade, traders protect their capital from significant losses. Additionally, maintaining a diversified portfolio helps spread risk across various assets.

Key components of an optimized trading plan:

Clear Objectives: Define specific and measurable trading goals.

Risk Management: Set appropriate stop-loss and position size limits.

Diversification: Spread investments across multiple markets and assets.

Regularly reviewing and updating your trading plan ensures it remains relevant and effective. This adaptability enables traders to respond promptly to market shifts, enhancing long-term profitability. A disciplined approach to following the plan fosters confidence in executing trades successfully.

Backtesting and Performance Evaluation

Backtesting is essential in assessing the viability of a trading strategy. It involves applying the strategy to historical data to gauge potential success. A thorough backtest can reveal strengths and weaknesses, helping refine the approach.

Performance evaluation goes hand-in-hand with backtesting. By measuring key metrics, traders gain insights into strategy effectiveness. Metrics like win rate, average return, and drawdown indicate the strategy’s performance under various conditions.

To conduct effective backtesting, accuracy is crucial. Use high-quality historical data to minimize errors and ensure realistic results. Keep in mind that past performance doesn’t guarantee future outcomes.

Key aspects of backtesting and performance evaluation:

Historical Data: Use accurate and relevant market data.

Key Metrics: Focus on win rate, return, and drawdown.

Strategy Optimization: Use insights to enhance performance.

Evaluating a strategy's performance allows traders to make informed decisions. Regular review and adaptation ensure strategies remain effective in dynamic markets. This ongoing process helps traders stay competitive and achieve desired outcomes.

Risk Management and Diversification

Risk management is crucial for sustaining success in trading. It involves identifying potential losses and implementing strategies to mitigate them. Effective risk management safeguards traders from catastrophic setbacks.

Diversification complements risk management by spreading investments across various assets. It reduces the risk of losses tied to a single asset. By diversifying, traders can benefit from different market conditions.

A diversified portfolio balances high-risk and low-risk investments. This approach enhances stability and potential returns. It also helps minimize the impact of market volatility on overall performance.

Key elements of risk management and diversification:

Diversify Investments: Spread across different assets and sectors.

Utilize Stop-Loss Orders: Limit potential losses efficiently.

Balance Portfolio: Include both high-risk and stable assets.

Incorporating risk management and diversification in a trading plan is essential. It provides a stable foundation to withstand market fluctuations. This strategic approach supports long-term trading success by protecting capital and enhancing growth opportunities.

Leveraging Technology and Tools

In today's trading landscape, technology plays a pivotal role. Advanced tools and platforms enhance efficiency and precision. By leveraging these technologies, traders can execute trades with greater speed and accuracy.

Algorithmic trading systems are popular for their ability to process vast data quickly. They help traders capitalize on market opportunities that manual processes may miss. Using such tools, traders can implement complex strategies effortlessly.

Choosing the right technology stack is critical for success. The right tools align with a trader's goals and enhance overall performance.

Technological tools to consider:

Algorithmic Trading Software: Automate complex strategies.

Market Analysis Platforms: Provide in-depth insights.

Risk Management Tools: Help manage and minimize potential losses.

Incorporating technology into trading practices maximizes potential returns. It empowers traders with the tools needed to thrive in competitive markets. Overall, leveraging technology is a crucial step toward achieving optimized trading success.

Psychological and Behavioral Factors in Trading

Trading success hinges not only on strategies and technology but also on psychology. Emotional discipline is vital in navigating market fluctuations. Without it, impulsive decisions can lead to losses.

Managing stress and maintaining focus enhance decision-making. Traders often underestimate the power of mindset in achieving success. A balanced emotional state supports clearer thinking.

Understanding common psychological pitfalls can prevent costly mistakes. Developing mental resilience is a continuous process. By focusing on psychological factors, traders can improve performance and maintain a competitive edge.

Key behavioral considerations:

Emotional Discipline: Avoid impulsive reactions.

Stress Management: Maintain focus under pressure.

Mental Resilience: Build a strong mindset for trading.

Adapting to Market Changes and Continuous Learning

Financial markets are dynamic, requiring traders to remain agile. Adapting to changes swiftly can provide a significant edge. Market conditions can shift unexpectedly, demanding proactive strategies.

Continuous learning is pivotal for long-term success. By staying informed, traders can respond effectively to emerging trends. Educating oneself can lead to innovative strategy adjustments.

Engaging with educational resources and communities aids personal growth. Trading webinars and workshops are valuable for learning. Open-mindedness to new techniques enhances trading approaches.

Key practices:

Stay Updated: Follow market news and trends.

Expand Knowledge: Attend courses and workshops.

Innovate Strategies: Adapt and refine to stay competitive.

Common Pitfalls and How to Avoid Them

Trading can be fraught with potential mistakes, especially for those new to the field. Understanding common pitfalls can help traders minimize losses. Overconfidence can lead to bigger risks than one can handle.

Sticking to a well-devised plan is crucial. Avoid impulsive trading based on emotions or market hype. This discipline is essential for maintaining consistency.

Key pitfalls to avoid:

Ignoring Risk Management: Always set stop-loss orders.

Overtrading: Limit trades to avoid exhaustion.

Chasing Losses: Accept losses without revenge trading.

Conclusion: Achieving Long-Term Trading Success

Success in trading requires more than just luck. It demands a blend of well-planned strategies, consistent discipline, and ongoing education. Traders must remain flexible, adapting plans as markets evolve.

By focusing on risk management and continuous improvement, traders can navigate the complexities of the financial markets. With patience and persistence, achieving long-term trading goals becomes more attainable. Remember, trading is a marathon, not a sprint.