Blogs

Top 7 Breakout Strategies for Successful Trading

Jan 12, 2026

Top 7 Breakout Strategies for Successful Trading

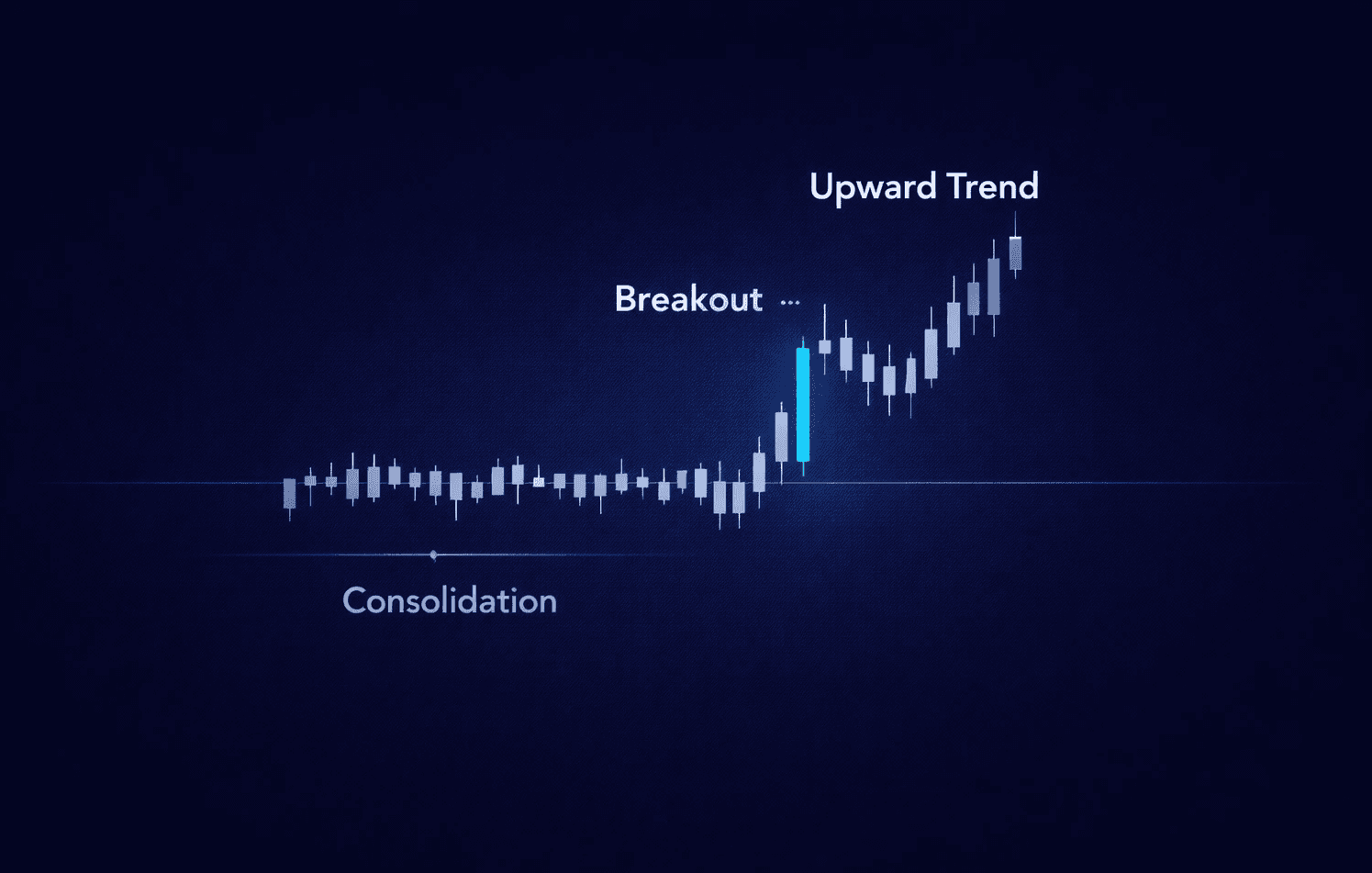

Breakout strategies are a cornerstone of successful trading. They help traders spot and seize price movements beyond key levels.

These strategies are versatile, working across various markets like stocks, forex, and commodities.

Understanding breakout strategies can enhance your trading skills. They offer a way to capitalize on market momentum.

However, not all breakouts lead to profits. False breakouts can result in losses if not managed well.

Incorporating technical indicators and risk management is crucial. This ensures you maximize gains while minimizing risks.

Explore these essential breakout strategies to elevate your trading game.

Understanding Breakout Trading Strategies

Breakout trading strategies aim to capture price shifts beyond existing support or resistance levels. These strategies are popular among traders looking for big moves in the market.

They involve observing price trends and understanding market dynamics. Successful breakout trading depends on several factors.

For effective breakout trading, traders must consider market volatility and volume. These elements play a crucial role in validating breakouts.

A reliable breakout strategy combines technical analysis with risk management. This dual approach helps protect against significant losses.

Definition and Importance

Breakout strategies focus on spotting price breaks from established trading ranges. These strategies help traders enter or exit positions at optimal points.

The importance of breakout strategies includes:

Identifying potential trade opportunities.

Maximizing profits through significant market moves.

Reducing risks by setting strategic entry and exit points.

Mastering these strategies can significantly enhance a trader's success rate.

Key Components of Breakout Strategies

Understanding breakout strategies requires knowing their key components. These components lay the groundwork for successful trading.

Key components include:

Identifying support and resistance levels.

Monitoring trading volume for breakout confirmation.

Timing entries and exits accurately with technical indicators.

Integrating these elements ensures robust breakout trading strategies. Traders who master these can improve their market analysis skills.

Classic Breakout Trading Strategy

The classic breakout strategy is a foundational method used by many traders. It relies on the prediction that prices will move significantly once they break out of a defined range.

This strategy often starts with identifying the trading range. Traders focus on strong support and resistance levels that contain price movements.

Success in classic breakout strategies hinges on timing. Quick execution at the right moment can maximize potential gains.

For precision, traders often incorporate indicators like moving averages. These indicators help confirm breakout signals and guide entry and exit decisions.

Identifying Support and Resistance

Pinpointing support and resistance levels is crucial. These levels represent price points where buying or selling pressure has stopped previous movements.

Traders can identify these levels by:

Observing historical price patterns.

Using trendlines on charts.

Employing horizontal lines to mark peaks and troughs.

These levels serve as signals for potential breakouts.

Entry and Exit Points

Determining entry and exit points ensures effective breakout trading. Timing here is as important as identifying the breakout itself.

To optimize these points, traders might:

Set entries just above resistance or below support.

Use stop-loss orders to limit potential losses.

Define profit targets to secure gains during a move.

Such measures help traders execute trades with precision and confidence.

Momentum-Based Breakout Strategy

A momentum-based breakout strategy builds on the idea that strong price moves are often followed by further price momentum. This strategy is popular among traders who capitalize on quick, substantial price changes.

Momentum-based strategies rely on the observation of accelerating prices. Traders aim to catch the wave of price movement before it slows or reverses.

Such strategies thrive in volatile markets. Increased volatility often signals a strong price trend, ideal for momentum trading.

Traders using momentum strategies should be prepared for swift action. This includes quick decision-making to enter or exit trades when required.

Why Momentum Matters

Momentum matters because it reflects the strength and sustainability of a price movement. Markets with strong momentum often lead to successful trades.

Reasons to focus on momentum:

Indicates a strong trend.

Confirms potential breakouts.

Identifies continuation patterns.

Understanding momentum helps traders predict price trajectories.

Using Indicators to Confirm Momentum

Indicators are essential for confirming momentum. They help traders validate price strength and ensure they enter trades at optimal points.

Common indicators for momentum confirmation include:

Moving Average Convergence Divergence (MACD).

Relative Strength Index (RSI).

Stochastic Oscillator.

These tools provide insight into the speed and direction of price movements. Incorporating them into trading strategies can enhance decision-making.

Volume-Supported Breakout Strategy

The volume-supported breakout strategy relies heavily on trading volume to verify and authenticate potential breakouts. Volume is a crucial factor in determining the reliability of a price move. High volume suggests stronger market conviction behind a price breakout.

Notably, breakouts accompanied by increased volume are more likely to sustain their direction. Low volume breakouts often indicate false signals, which can trap unsuspecting traders.

Volume analysis pairs well with other technical indicators, like support and resistance levels, to provide a comprehensive view. When both volume and price signals align, traders can increase confidence in their trades.

To effectively use volume in breakout strategies, traders should keep an eye on volume spikes. Significant increases might signal the beginning of a strong trend.

Importance of Trading Volume

Trading volume offers a glimpse into market enthusiasm and participation during price moves. It is a reflection of market strength and trader interest.

Reasons to watch volume:

Confirms price movements.

Distinguishes between strong and weak breakouts.

Alerts to potential reversals.

Monitoring volume levels helps traders gauge the sustainability of a price trend.

How to Use Volume in Breakouts

To utilize volume in breakout strategies, traders should watch for specific volume patterns. These patterns can provide crucial context to price actions.

Consider the following steps:

Identify volume spikes.

Compare volume before and after breakout levels.

Look for above-average volume to confirm a breakout.

These observations help verify the validity of breakout signals, enhancing the reliability of trading decisions.

Algorithmic Trading and Breakout Strategies

Algorithmic trading is revolutionizing how traders engage with financial markets. By automating trading processes, algorithms execute trades based on predefined criteria quickly and without emotion. Incorporating algorithmic methods into breakout strategies can significantly boost efficiency and consistency.

Algorithmic trading involves using mathematical models to identify breakout opportunities. With the ability to process vast datasets and identify patterns, algorithms can pinpoint optimal entry and exit points much faster than a human trader.

Key features of algorithmic trading include:

Speed and precision in trade execution.

Ability to backtest strategies against historical data.

Reduction of human error through rule-based trading.

Integrating algorithmic trading with breakout strategies can enhance decision-making and improve trade outcomes. Traders can better adapt to fluctuating market conditions.

Overview of Trading Algorithms

Trading algorithms are computational programs that automate trades. They execute by following specific rules set by traders.

Features of trading algorithms:

Evaluate technical indicators.

Analyze historical data.

Execute trades automatically.

These algorithms help traders maintain discipline and remove the influence of emotion, leading to more consistent results.

Benefits of Algorithmic Trading in Breakouts

Algorithmic trading offers several advantages when applied to breakout strategies. It increases precision and efficiency by executing trades at optimal moments.

Benefits include:

Faster response times to market changes.

Reduced risk of emotional trading errors.

Enhanced ability to exploit small price movements.

Overall, integrating algorithmic strategies provides traders with a robust framework to capitalize on breakout opportunities effectively.

Automation in Breakout Trading

Automating breakout strategies can enhance a trader's ability to capture profitable opportunities. Using technology allows for more consistent and disciplined trading, reducing emotional interference. Automation simplifies executing complex strategies while ensuring that trades align with predefined rules.

Breakout trading relies heavily on timing, making quick execution crucial. Automated systems can react to market movements far quicker than manual methods, securing advantageous entry and exit points. This speed is especially beneficial when operating in fast-moving markets.

Many automated trading platforms allow traders to customize their algorithms, tailoring them to fit individual trading goals and risk tolerances. By setting clear parameters, traders can ensure their strategies operate seamlessly, even when they're not actively monitoring the market.

Key advantages of automated breakout trading include:

Consistency in trade execution.

Ability to handle multiple trades.

Reduction of emotional trading errors.

Setting Up Automated Strategies

Creating automated trading strategies involves several steps. First, traders define clear rules for identifying breakout setups. This includes specifying technical indicators and setting conditions for entering and exiting trades.

Steps to set up an automated strategy:

Choose a reliable trading platform.

Define entry and exit criteria.

Backtest the strategy with historical data.

Implementing these steps ensures that the strategy performs as intended under different market conditions.

Pros and Cons of Automated Breakout Trading

Automated breakout trading offers numerous benefits, but it also has potential drawbacks. Understanding these can help traders make informed decisions.

Advantages of automation:

Improved efficiency and accuracy.

Ability to trade 24/7 without fatigue.

However, there are cons:

Lack of flexibility in unforeseen events.

Dependency on technology and reliable internet connections.

Balancing these pros and cons allows traders to maximize automation benefits while minimizing potential risks.

Common Pitfalls and Risk Management

Breakout strategies can be profitable but come with potential pitfalls. Understanding these pitfalls is essential for minimizing losses.

One common issue is the occurrence of false breakouts, leading traders to enter positions too early. Such errors can result in quick losses, impacting overall strategy success.

Effective risk management is crucial in breakout trading. It includes setting stop-loss orders and determining the right position size. These actions help mitigate risks associated with incorrect market movements.

Another challenge is overreliance on breakout signals without considering market context. Traders may overlook other factors like economic news or market sentiment, leading to suboptimal decisions.

Key pitfalls to avoid:

Ignoring market context.

Failing to set stop-loss orders.

Neglecting volume confirmation for breakouts.

By recognizing these pitfalls, traders can refine their strategies, enhancing their overall success and confidence in breakout trading.

Essential Risk Management Techniques

Effective risk management techniques are vital for successful breakout trading. They protect traders from significant losses and ensure longevity in the market.

Key techniques include:

Setting stop-loss orders to limit potential losses.

Using position sizing to manage exposure.

These methods help traders maintain control over their trades, reducing emotional decisions and preserving capital.

Avoiding False Breakouts

False breakouts pose a significant challenge, often misleading traders into unprofitable positions. Recognizing and avoiding them is crucial for strategy success.

Tactics to avoid false breakouts include:

Confirming breakouts with volume analysis.

Waiting for a candlestick close beyond resistance levels.

By applying these tactics, traders reduce the risk of entering premature trades, minimizing potential losses while enhancing strategy effectiveness.

Conclusion

Mastering breakout strategies is essential for traders seeking to capitalize on market movements. By understanding the core components and refining techniques, traders can improve their success.

Each strategy offers unique insights and opportunities. Tailor them to fit your trading style and objectives. Continually adapt strategies in response to changing market conditions.

Combining breakout strategies with solid risk management provides a robust trading approach. This balance can enhance your trading confidence and results.