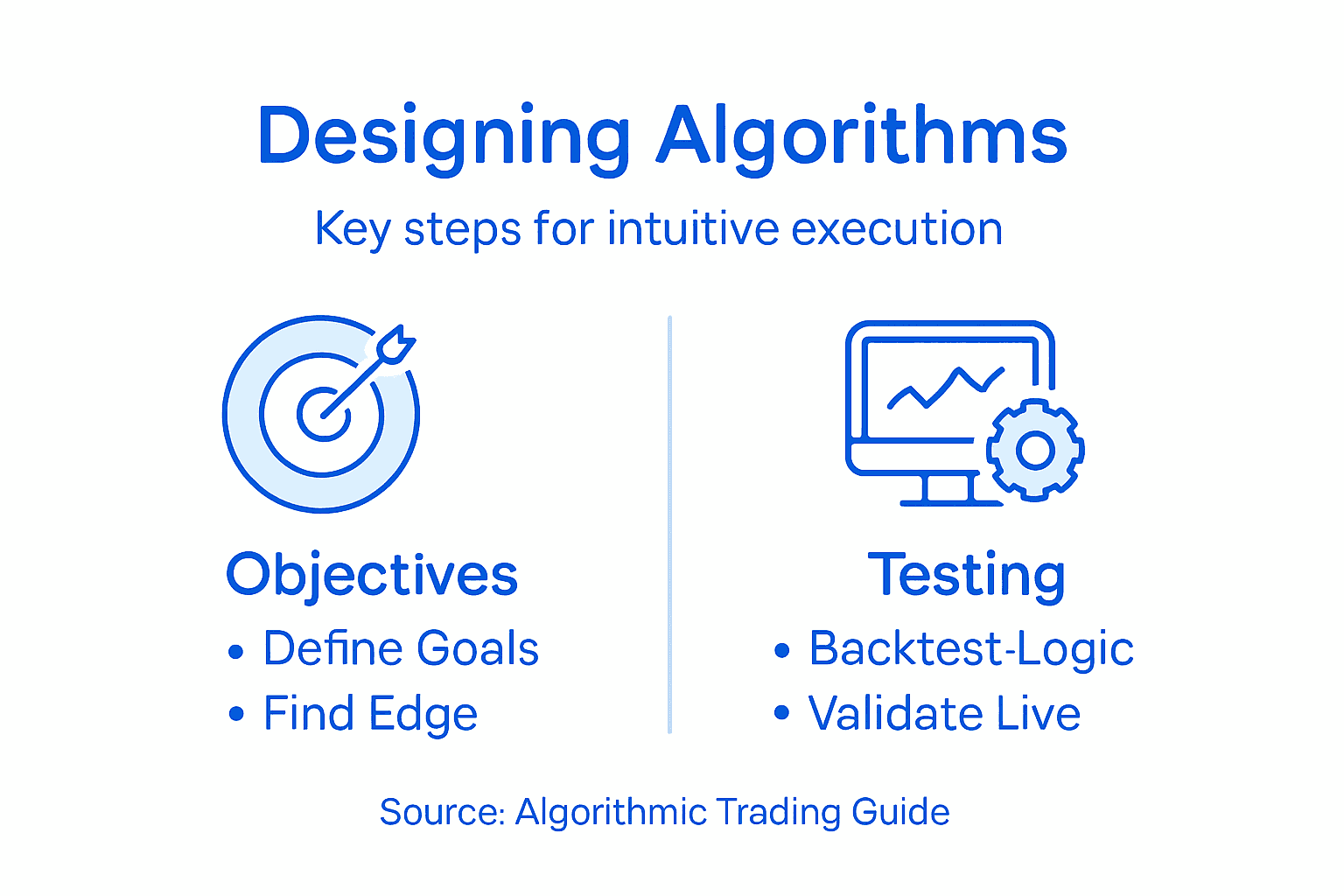

How to Design Trading Algorithms for Intuitive Execution

Discover how to design trading algorithms using actionable steps, harness your intuition, validate with data, and achieve consistent, quantifiable results.

Feb 5, 2026

How to Design Trading Algorithms for Intuitive Execution

Every intermediate trader knows the difference a well-defined edge makes in challenging markets. Transforming market insights into a structured, repeatable process is what separates consistent performers from the crowd. By focusing on defining clear trading objectives and a uniquely quantifiable edge, you lay the groundwork for trading algorithms that systematically capitalize on real opportunities. This guide shows you how to connect intuition with robust, rule-based strategies for greater clarity and stronger, data-driven decisions.

Table of Contents

Step 1: Define Key Trading Objectives And Market Edge

Step 2: Translate Intuition Into Quantifiable Algorithm Logic

Step 3: Select And Source Historical Market Data For Testing

Step 4: Implement And Code The Trading Algorithm Structure

Step 5: Backtest And Optimize Algorithm Performance

Step 6: Validate Algorithm In Live Or Simulated Environments

Quick Overview

Key Insight | Explanation |

1. Define your trading edge | Identify unique advantages to improve success. Understand skills and create customized entry and exit strategies. |

2. Develop objective criteria | Create measurable rules for trading decisions. Clear thresholds avoid emotional bias in trading. |

3. Source reliable historical data | Quality data is vital for backtesting accuracy. Analyze various market conditions and ensure comprehensive records. |

4. Implement rigorous backtesting | Test algorithms against real market scenarios. Optimize strategies using thorough performance evaluations and parameter adjustments. |

5. Validate in live conditions | Assess algorithm performance in real markets gradually. Use paper trading and limited capital for risk-controlled testing. |

Step 1: Define key trading objectives and market edge

Defining your trading objectives and market edge is the critical foundation for designing an effective algorithmic trading strategy. This step transforms abstract market insights into a structured, executable plan that differentiates your approach from standard trading methods.

To establish your market edge, you’ll need to identify specific advantages that give you a statistical probability of success. Defining a trading edge involves understanding precise technical skills and creating customized strategies with clear entry, exit, and trade management rules.

Key components of defining your trading objectives include:

Specifying your desired return goals

Establishing risk tolerance parameters

Identifying specific markets or asset classes

Determining your unique competitive advantage

Successful algorithmic traders focus on exploiting specific market inefficiencies. This might involve statistical arbitrage, trend following, mean reversion, or other specialized approaches that leverage your unique market perspective. Quantify your potential edge by analyzing historical data and understanding how your strategy performs under different market conditions.

Your trading edge is not about predicting markets perfectly, but about creating a statistically robust approach that consistently generates positive returns.

Develop precise trade selection criteria that align with your market understanding. This means creating clear, objective rules for:

When to enter a trade

How much capital to allocate

Specific exit conditions

Risk management protocols

Pro tip: Always backtest your trading objectives against multiple market scenarios to validate the robustness of your algorithmic strategy.

Step 2: Translate intuition into quantifiable algorithm logic

Translating trading intuition into a systematic algorithmic approach requires transforming subjective market insights into precise, executable rules. This crucial step bridges the gap between human perception and machine-driven trading strategies.

Converting trading ideas demands breaking down complex market observations into measurable, objective parameters that an algorithm can consistently interpret. Your goal is to remove emotional bias and create a set of clear, repeatable rules that capture the essence of your trading strategy.

Key steps in translating intuition include:

Identifying specific technical indicators that match your market perspective

Defining exact entry and exit conditions

Quantifying risk management parameters

Creating numerical thresholds for decision-making

Deconstruct your trading intuition by analyzing the underlying patterns and signals that drive your decision-making process. This means converting subjective observations like “the market feels bearish” into concrete, measurable criteria such as:

Specific moving average crossover points

Relative strength index (RSI) thresholds

Volume-based entry and exit signals

Price action pattern recognition

Successful algorithmic trading transforms subjective market insights into precise, quantifiable rules that can be systematically executed.

To achieve this translation, you’ll need to:

Document your current trading decision-making process

Break down each decision into measurable components

Create numerical rules that replicate your thought process

Test and refine these rules against historical market data

Develop objective decision criteria that remove emotional interference and create a consistent trading approach. This means transforming gut feelings into statistically verifiable trading signals that can be programmed and executed without human intervention.

Pro tip: Regularly compare your algorithm’s performance against your manual trading to ensure the quantified logic truly captures your original market intuition.

Step 3: Select and source historical market data for testing

Selecting and sourcing historical market data is a critical foundation for building a robust trading algorithm. Your data selection will directly determine the reliability and accuracy of your backtesting and eventual trading performance.

Sourcing reliable historical data requires careful consideration of market conditions, asset classes, and timeframes that align precisely with your trading strategy. The quality of your data can make or break your algorithmic trading approach.

Key considerations for data sourcing include:

Comprehensive price and volume information

Appropriate time resolution (tick, minute, hourly data)

Coverage of multiple market cycles

Inclusion of various market conditions

Evaluate data sources based on several critical factors:

Accuracy of historical price records

Completeness of market information

Granularity of data points

Cost and accessibility of data platforms

High-quality historical data is the foundation of any successful algorithmic trading strategy.

Recommended data sources for traders include:

Here’s a comparison of data source types for historical market testing:

Data Source Type | Data Quality | Accessibility | Typical Cost |

Professional Provider | High | Subscription | Moderate to High |

Open-source Repository | Moderate | Free | No cost |

Exchange Database | High | Direct purchase | Variable |

Algorithmic Platform | High | Integrated access | Moderate |

Professional financial data providers

Open-source market data repositories

Exchange-specific historical databases

Specialized algorithmic trading platforms

Validate your data collection by checking for:

Consistent time intervals

Accurate price adjustments for splits and dividends

Comprehensive market event recordings

Minimal data gaps or anomalies

Prepare your historical dataset by cleaning and standardizing the information. This involves removing outliers, filling missing data points, and ensuring consistent formatting across your entire historical record.

Pro tip: Always maintain multiple backup sources of historical market data to cross-reference and validate your primary dataset.

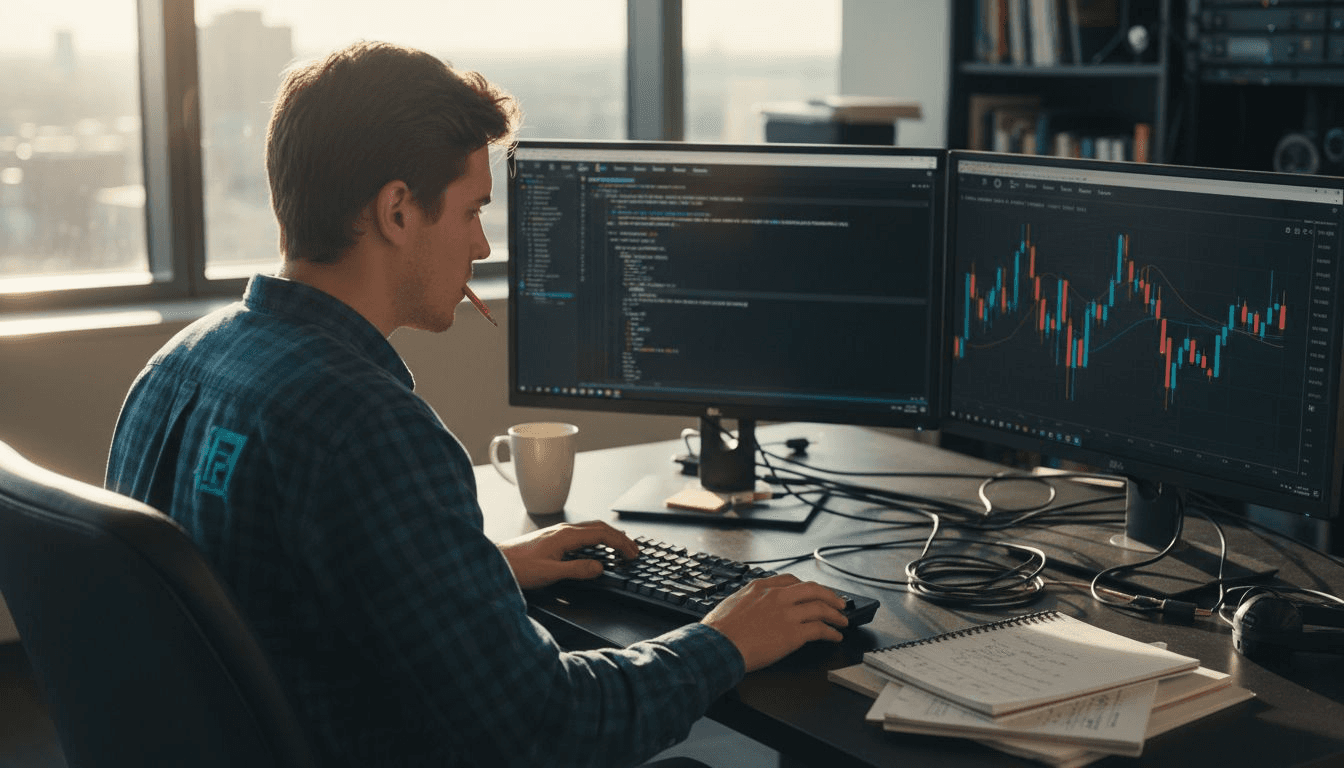

Step 4: Implement and code the trading algorithm structure

Implementing and coding your trading algorithm transforms your strategic insights into a functional, executable system. This critical phase bridges the gap between theoretical strategy and practical trading execution.

Algorithmic risk parameters require precise translation from conceptual design into structured, executable code that can systematically interpret market signals and make trading decisions.

Key structural components of algorithm implementation include:

Defining entry and exit logic

Establishing risk management protocols

Creating position sizing mechanisms

Implementing signal generation rules

Design your algorithm’s core architecture by breaking down complex trading logic into modular, reusable components. This means creating distinct functions for:

Market data processing

Signal generation

Trade execution

Performance tracking

A well-structured algorithm transforms market insights into repeatable, quantifiable trading decisions.

Implementation steps require careful consideration:

Select an appropriate programming language

Develop modular code structures

Implement error handling mechanisms

Create flexible configuration parameters

Build robust error handling to ensure your algorithm can gracefully manage unexpected market conditions. This includes:

Implementing fail-safe exit strategies

Creating comprehensive logging mechanisms

Developing adaptive response protocols

Establishing backup decision pathways

Optimize algorithm performance by focusing on:

Computational efficiency

Minimal latency in decision-making

Scalable code architecture

Simplified maintenance protocols

Pro tip: Always implement a “paper trading” mode that allows your algorithm to execute trades in a simulated environment before live deployment.

Step 5: Backtest and optimize algorithm performance

Backtesting and optimizing your trading algorithm transforms theoretical strategies into statistically validated trading approaches. This critical phase enables you to rigorously assess and refine your algorithm’s potential performance before risking actual capital.

Robust backtesting techniques simulate realistic market conditions, factoring in critical variables like transaction costs, slippage, and execution latency. Your goal is to create a comprehensive performance evaluation framework that reveals both potential strengths and hidden vulnerabilities.

Key backtesting considerations include:

Selecting representative historical market periods

Accounting for realistic trading costs

Modeling potential market frictions

Analyzing performance across different market regimes

Develop a comprehensive backtesting framework that provides multidimensional insights:

Performance metrics calculation

Risk-adjusted return analysis

Drawdown assessment

Correlation with market benchmarks

Effective backtesting transforms raw trading ideas into statistically validated strategies with demonstrable edge.

Optimization strategies involve:

Parameter sensitivity analysis

Walk-forward optimization techniques

Monte Carlo simulation

Stress testing under extreme market conditions

Refine algorithm parameters by systematically exploring:

Entry and exit timing variations

Position sizing adjustments

Risk management protocol modifications

Signal generation threshold refinements

Validate algorithm robustness through rigorous testing protocols that challenge your strategy’s core assumptions and reveal potential weaknesses before live deployment.

Pro tip: Implement a rolling window backtesting approach that continuously validates your algorithm against evolving market dynamics.

Step 6: Validate algorithm in live or simulated environments

Validating your trading algorithm in real or simulated market conditions is the critical bridge between theoretical design and practical performance. This stage reveals how your algorithm truly performs under dynamic market pressures.

Algorithmic validation techniques provide a risk-controlled method to test your strategy’s real-world effectiveness, allowing you to identify potential issues before committing significant capital.

Validation approaches include:

Paper trading with real-time market data

Limited capital live trading

Simulated market environment testing

Incremental risk exposure strategies

Implement comprehensive validation protocols by:

Here’s a summary of trading algorithm validation approaches and their typical use case:

Validation Method | Market Conditions Tested | Capital Risk Level | Best Use Case |

Paper Trading | Real-time, simulated prices | None | Early stage strategy testing |

Limited Capital Live | Actual, but small scale | Low | Controlled real-world trial |

Simulated Environments | Customizable, scenario-based | None | Stress-testing rare events |

Incremental Deployment | Live, increasing allocation | Gradual | Phased algorithm rollout |

Monitoring execution quality

Tracking performance metrics

Comparing simulated versus expected results

Identifying potential operational constraints

Real market validation transforms theoretical algorithms into robust, actionable trading systems.

Key validation steps involve:

Select appropriate testing environment

Define clear performance benchmarks

Monitor algorithm behavior

Document detailed performance metrics

Assess algorithm resilience through systematic evaluation of:

Transaction cost implications

Execution speed and latency

Market impact considerations

Unexpected market scenario responses

Track comprehensive performance indicators that go beyond simple profit metrics. These include drawdown characteristics, win-rate consistency, and risk-adjusted returns.

Pro tip: Allocate at least three consecutive months for thorough algorithm validation before considering full-scale deployment.

Unlock the Power of Intuitive Algorithmic Trading Today

Designing trading algorithms that truly capture your intuition is no small feat. The challenge lies in translating complex, subjective market insights into clear, quantifiable rules that deliver a robust trading edge. Whether you struggle to define precise trade selection criteria or worry about validating your strategy under real market conditions, the difficulty of bridging human intuition with systematic execution can feel overwhelming.

At Nvestiq, we have revolutionized this process. Our platform understands the nuance of real trader intuition and enables anyone to convert simple conversations into proven, quantifiable trading edges. By combining your market perspective with advanced algorithmic capabilities, you gain a competitive advantage that traditional approaches simply cannot match.

Experience firsthand how you can systematize your trading intuition with ease. Visit Nvestiq to explore a solution designed specifically for traders seeking to turn subjective insights into actionable algorithmic strategies. Don’t wait to elevate your trading. Start building intuitive, powerful algorithms now at https://nvestiq.com.

Learn more about connecting your real-time market perspective to actionable algorithms on our landing page at Nvestiq.

Make algorithmic trading simple and intuitive with Nvestiq today.

Frequently Asked Questions

What are the initial steps in designing a trading algorithm?

To design a trading algorithm, start by defining your trading objectives and market edge. Specify your return goals, risk tolerance, and unique competitive advantage to create a structured plan that guides your strategy.

How can I convert my trading intuition into a systematic algorithm?

To convert your trading intuition into a systematic algorithm, break down your trading decisions into measurable rules. Identify specific technical indicators and define exact entry and exit conditions that your algorithm can execute without emotional bias.

Why is historical market data important for algorithm testing?

Historical market data is crucial for testing your algorithm because it allows you to backtest your strategy under varying market conditions. Ensure you select data that covers multiple market cycles and includes comprehensive price and volume information to validate your approach effectively.

How do I optimize the performance of my trading algorithm?

To optimize your trading algorithm’s performance, conduct backtesting using various market scenarios and refine your parameters through sensitivity analysis. Aim to improve your algorithm’s profitability and reduce drawdown within 30–60 days of testing.

What validation methods can I use to test my trading algorithm?

You can validate your trading algorithm through methods such as paper trading, limited capital live trading, and simulated environment testing. Implement these methods to monitor your algorithm’s performance and ensure it can handle real market conditions effectively.

How long should I conduct validation before deploying my trading algorithm?

It’s recommended to allocate at least three consecutive months for thorough validation of your trading algorithm. This period allows you to track performance metrics and adjust your strategy based on real-time data before full-scale deployment.